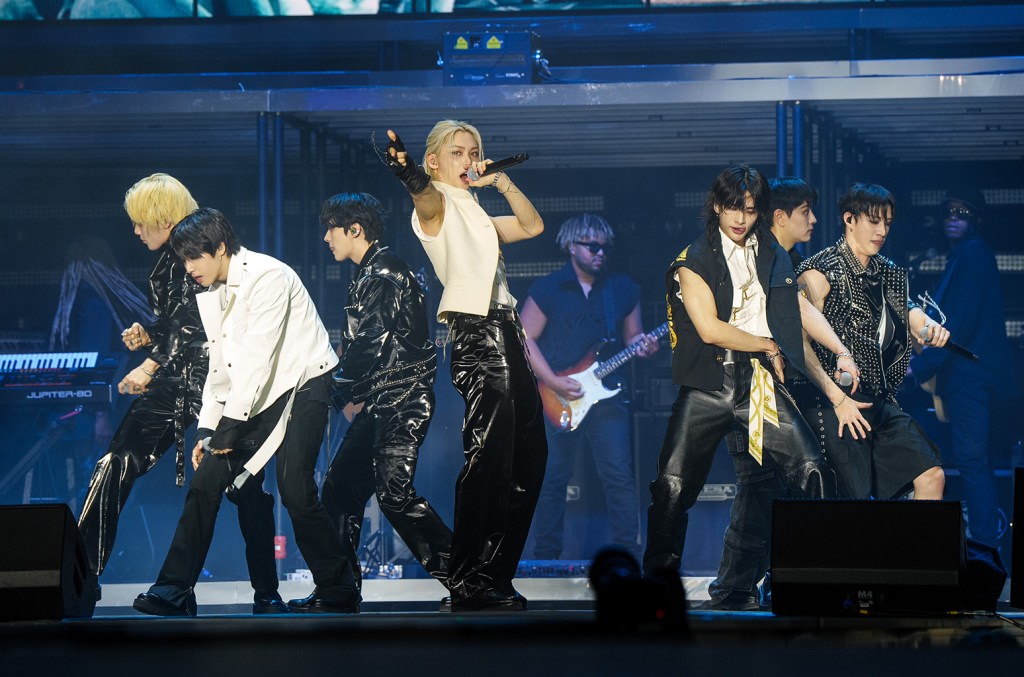

JYP Entertainment, the K-pop label behind artists such as TWICE and Stray Kids, is on the rise, with its stock closing Friday (Nov. 22) at 66,100 won ($47.06) — up 11.3 % for the week and mark its highest closing price since May 10. This week, the label appears to have gotten a boost from Monday's (Nov. 18) announcement of Stray Kids' 20-date Live Nation-produced 2025 Stadium Tour, which will span North America, Latin America and Europe. But the momentum has been building for a while. over the past three weeks, JYP shares have recorded gains of 35.6%.

Other K-pop stocks also posted gains this week: YG Entertainment rose 7.7% as ROSÉ and Bruno Mars' “APT” spent a fourth week at the top Bulletin board world charts and reached No. 1 in Japan. Elsewhere, HYBE improved 4.4% and SM Entertainment rose 4.3%. Collectively, the four K-pop companies have gained an average of 20.7% over the past three weeks and narrowed their average year-to-date deficit to 15%.

Another big music stock was Live Nation, which jumped 8.7% to a record high of $140.26 on Friday after more analysts raised their price targets. Citigroup raised its price target on the concert promoter to $163 from $130, while Deutsche Bank raised its price target to $150 from $130. Since Friday's closing price, Live Nation shares have gained 49.8% in 2024 and 19.8% in the past three weeks alone. However, the company's third-quarter earnings on Nov. 11 can be credited for some of the recent gains Donald TrumpHis victory in the US presidential election also played a role, as investors believe Live Nation's ongoing lawsuit brought by the Department of Justice will have a more favorable resolution with the incoming administration.

In other music stock news, Spotify continued its hot streak, gaining 3.7% to $475.27, marking its second-highest closing price ever. A week earlier, Spotify shares gained 14.5% after the company's third-quarter earnings showed the company achieved a record operating profit. The streaming company's stock has gained 153% in 2024 and is up 23.6% in the last three weeks alone.

The 20-company Billboard Global Music Index rose 2.1 percent to a record 2,208.32 as 14 stocks ended the week with gains, putting it in line with stocks around the world. In the United States, both the Nasdaq composite and the S&P 500 rose 1.7%. In the UK, the FTSE rose 2.5%. South Korea's KOSPI composite rose 3.5 percent. Only China's Shanghai Composite was an exception, down 1.9%.

Elsewhere, music streamer LiveOne gained 12.8% to $0.88, while iHeartMedia improved 8.6% to $2.40 after the radio giant announced a debt swap that will reduce the company's financial burden and will extend most maturity dates on its debts. As of November 14, holders of notes representing about 85% of the outstanding debt agreed to exchange notes under the new terms.

Just six of the index's 20 stocks ended the week in negative territory. The biggest decliner was German concert promoter CTS Eventim, which fell 9.7% this week after the company's third-quarter earnings showed a rise in revenue but a drop in EBITDA depreciation (EBITDA). promotion and ticketing departments.

Finally, corporate giant Warner Music Group ( WMG ) fell 3.3% to $31.85 after releasing its latest quarterly earnings on Thursday (Nov. 21). JP Morgan cut its price target to $40 from $41 after cutting its estimate for 2025 adjusted operating income before depreciation and amortization (OIBDA) to $1.49 billion from $1.527 billion. Meanwhile, Deutsche Bank cut its WMG price target to $34 from $36.

Created with Datawrapper

Created with Datawrapper

Created with Datawrapper