This July, some six years after the Hipgnosis Songs Fund (HSF) debuted on the London Stock Exchange, the relatively short-lived experiment in exchange-traded funds — also known as investment trusts — will likely come to an end. Global investment giant Blackstone is expected to win at least three-quarters of HSF shareholders with its $1.58 billion bid to buy the 65,000-song catalog.

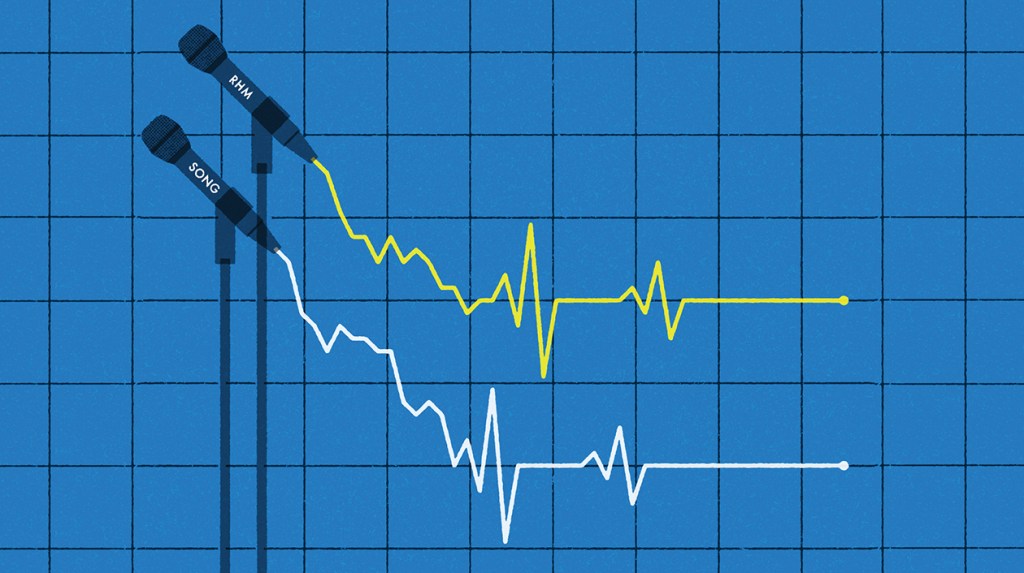

The only other listed fund, the Round Hill Music Royalty Fund, was taken private in November when it was acquired by Concord for $468 million. But short-lived though they were, these funds changed the way the investment world looked at music. Founder of Hipgnosis Merck Mercuriadis led to the push to convince institutional investors of the stable, non-cyclical nature of song rights, and they poured billions into the asset class, driving song catalog prices to record highs and sparking an acquisition frenzy that meant creators were getting more money than for selling the rights to their work.

Investments in music rights continue to thrive in the private market – where funds Hipgnosis and Round Hill continue to operate – but money is now flowing into asset-backed securities, the same financial vehicle used to create 'Bowie bonds' in 1990s. In the past two years, Concord, Kobalt, HarbourView Equity Partners, Chord Music Partners and others have raised $3.3 billion using securitizations, and music copyright investors say money of that size will help sustain prices of listings and multiples near record levels.

Despite the game changers Hipgnosis and Round Hill have had in the music industry, they have faced a number of obstacles. First, investors “misunderstood” how music copyright gives management control to the owner, co-founder of Round Hill Josh Gross says. This was confirmed by the due diligence report HSF released in March, which showed investors did not understand the rights HSF had acquired or the lack of control it had over much of its portfolio.

But interest rates may have been the death knell. When interest rates were low, HSF and Round Hill offered attractive returns for an acceptable level of risk, but when interest rates started to rise, the mutual fund's dividends were not so attractive. By the end of 2022, the Bank of England's official bank rate has risen to 3.5%, which has put downward pressure on HSF's share price because the risk-free rate was not far from the fund's dividend. Round Hill was similarly affected. “If you can put your money in the bank and earn 4.5%,” says Grouse, “Round Hill shouldn't [pay investors] 4.5%”.

HSF had other problems, including heavy debt and long-term debt that was given on September 7, 2022; Financial Times article that described the stagnation of HSF's growth as interest rates rose and a sluggish share price that left the fund unable to sell additional shares to finance catalog buybacks. “If the [Financial Times] thinks it's a problem, it's likely to be a problem,” he says Philipp Sauer of ContourMusik, a company specializing in private securitizations of musical assets.

If HSF had been founded today, it might have focused more on asset-backed securitizations. First developed in the music business by David Bowie in 1997 to raise $55 million from his recorded music catalog, it allows companies that own music rights to sell debt, using music rights as collateral.

The size of recent ABS deals dwarfs the money raised by Bowie bonds. In 2022, Concord brokered a $1.8 billion securitization and Chord, a business of KKR Credit Advisors and Dundee Partners, did a $733 million securitization. Hipgnosis Song Management, a different Hipgnosis firm that advises HSF, also raised $222 million through an ABS that year. In 2024, HarbourView and Kobalt entered into ABS deals of $500 million and $267 million, respectively, and sources say many more undisclosed securitizations have closed in recent years.

While both ABS and the investment trust model allow investors to purchase recorded music and publishing rights, there are key differences between the two. ABS debt is purchased by institutional investors such as pension funds and insurance companies with time horizons that match the long duration of the music assets. “They're not that impatient [as retail investors]” says Saure, “so you don't have that 'trial in the court of public opinion' element.

Institutional investors' need for a certain rate of return is an approach that works well with established music catalogs that consistently generate cash. Shares of Universal Music Group or Warner Music Group are “speculative” investments that could lose money or make double-digit gains, says a banking source, who adds that “public investors are growth investors, not just cash flow investors » that seek a steady RETURN. In contrast, ABS investors know exactly what to expect in a particular period.

ABS offerings are complex and involve ongoing administration and generally high costs, but they can be worth the effort. “Each structure has its pros and cons and each is better suited to different market conditions,” Reservoir Media CEO Golnar Khosrowshahi says. “Securitization today is attractive because it is declining [the] cost of capital in this interest rate environment'.

CFO of Concord Kent Hoskins he says he prefers the flexibility of securitizations over traditional debt: “We really liked the capital structure that allowed us to relatively easily raise new debt for new acquisitions.” An ABS creates a trust that manages a collection of assets that acts as collateral for investors. If Concord is within its terms, such as a certain loan-to-value ratio — the size of a loan compared to the value of an asset purchased with the loan — it explains, the company can take on more debt than a list's particular value. . Term loans are more restrictive, he adds, and give the borrower a lower loan-to-value ratio. Concord struck a deal for the 2022 ABS with what Hoskins calls a “relatively low” loan-to-value ratio in the “low 40s” compared to ABS deals he says have been as high as 65%. That buffer allowed the music company to make another issue in 2023 for $500 million, which funded the Round Hill Music Royalty Fund's $468 million buyout in November.

Music may be a stable, recession-proof commodity, but well-diversified ABS offerings are not without risk. One source points to AI as a factor that could jeopardize stable cash flow if it causes a major economic shift like pirated music did in the early 2000s.

In general, however, institutional investors view music as a safe asset class over time. “There's been a lot of demand for every ABS music deal we've done,” says the same source. “As some of the retail money moves away,” Saure adds, “institutions are becoming more confident.”