The consortium acquiring French music label Believe has increased its holdings to 94.99% of the share capital at the close of the auction, the company announced on Monday (June 25th). This marks an increase of almost 10% from the 85.04% stake held by the consortium a week earlier.

Led by the CEO Denis Ladegaillerie, who founded Believe in 2005 to capitalize on its fast-growing digital music business, the consortium bought 19.6 million shares at 15.00 euros ($16.10) per share during the offering, which lasted from June 3rd to June 21st. Combined with blocks of shares previously acquired from investors, the consortium now owns 95.6 million of the 100.7 million shares outstanding. Free float — shares owned by minority investors — is 5.01%. The consortium, which also includes major shareholders EQT and TCV, owns 106.5 million of Believe's 113 million — 94.29% — voting rights.

While the consortium does not plan to do a mandatory divestment for shares not tendered by minority shareholders because the free float — shares not held by insiders that can be traded publicly — has fallen below 15%, believe it will certain stock indices are delisted from the stock market.

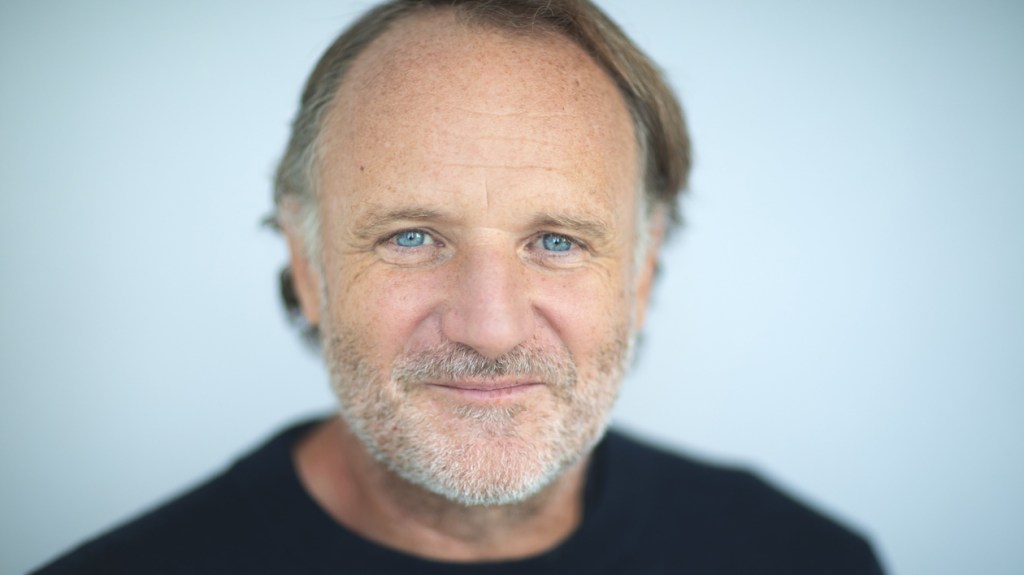

Also on Monday, Believe announced his appointment Andrew Fisher, a new director representing EQT, after venture capital firm Ventech sold its stake in the consortium and lost a director. Fisher's ratification will be voted on at the 2024 annual general meeting. The board also appointed two observers: Michael Kalfaiangeneral partner at TCV, and Nicolas Brugèrepartner at EQT.

The consortium announced a takeover bid for Believe in February at 15.00 euros ($16.10), which represented a 21% premium to its previous closing price. According to an offer document, the consortium wants to take over the company “to better execute its value creation plan and accelerate the scaling of an independent player supporting artists and label clients” and “further grow and establish a position as a leader in the French and European market”.

After Believe's board approved the takeover bid on April 19, the consortium bought a large block of shares from venture capital firms XAnge and Ventech. Before the acquisitions, TCV was the largest shareholder with 41.1% of the share capital, while Ladegaillerie held 12.5%, private equity firm Ventech held 12.0%, XAnge held 6.3% and about 3.8% of the shares were held by a strategic holding fund and in the fund units. Free dispersion was 24.4%.

Warner Music Group briefly considered a takeover of Believe in March and estimated an offer of “at least” 17 euros ($18.24) per share, which would value the company at 1.65 billion euros ($1.8 billion) . But the pursuit was short-lived. Warner dropped out of the running in April.